From Barter to Blockchain: 8 Payment Milestones

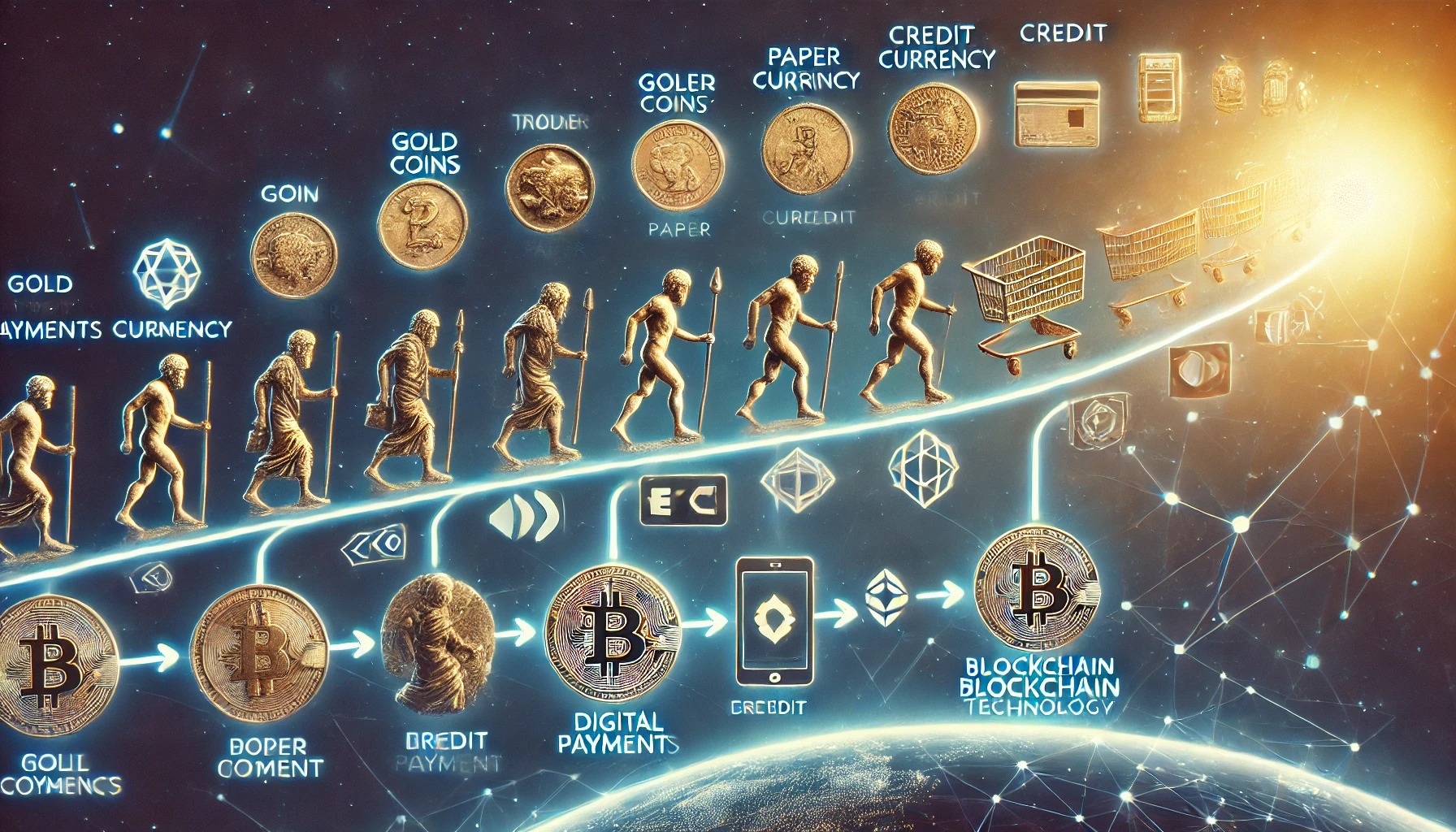

The journey of payment methods is a fascinating tale that traces humanity’s quest for efficiency and trust in trade. From the earliest days of bartering goods to the sophisticated blockchain technology we see today, each milestone has shaped our economic landscape. Understanding this payment evolution is not just an academic exercise; it’s crucial for anyone interested in the future of finance. As we navigate a world increasingly dominated by digital transactions, recognizing the historical context helps us appreciate the innovations that continue to redefine how we exchange value.

Consider how cash transactions once ruled the marketplace, giving way to credit cards that revolutionized consumer spending. These advancements didn’t merely change how we pay; they transformed our entire approach to money and commerce. Today, as we stand on the brink of further innovation with cryptocurrencies and blockchain, it’s vital to reflect on our past. Each step in this evolution has laid the groundwork for new financial possibilities. Join us as we explore eight pivotal milestones that highlight this remarkable journey and offer insights into where we might be headed next.

The Age of Barter

The barter system, recognized as the earliest form of trade, involved the direct exchange of goods and services without a standardized medium of exchange. In ancient societies, individuals would trade items of perceived equal value—such as livestock for grain or tools for clothing—allowing communities to satisfy their needs through mutual agreement. This rudimentary method of commerce thrived in small, localized economies where personal relationships and trust played a pivotal role in transactions. However, as populations grew and markets expanded, the limitations of barter became increasingly evident, prompting the search for more efficient payment methods.

One of the primary challenges of bartering was the “double coincidence of wants,” which required both parties to desire what the other offered at the same time. For instance, if a farmer wanted shoes but had only vegetables to offer, he would need to find a shoemaker who also wanted vegetables—a scenario that could lead to frustrating delays or missed opportunities. Furthermore, the subjective nature of value made it difficult to establish fair trades. These limitations not only hindered economic growth but also created obstacles in the development of complex societies, where varied goods and services were needed for a thriving economy.

As communities evolved into more intricate social structures, the need for standardized payment methods became imperative. The inefficiencies of bartering prompted early civilizations to seek alternatives that could facilitate trade on a larger scale. This transition laid the groundwork for the emergence of coinage and, ultimately, more sophisticated financial systems. The shift from bartering to structured payments marked a significant milestone in payment evolution, paving the way for future innovations such as cryptocurrencies and digital payments that we rely on today. By understanding this foundational era, we can appreciate how these early practices influenced not only economic systems but also societal dynamics as they transitioned toward organized commerce.

Emergence of Coinage

The introduction of coinage marked a significant turning point in the history of trade, transforming how goods and services were exchanged. Before coins, bartering was the norm—individuals would trade items directly based on perceived value. However, this method was fraught with inefficiencies, as it required a mutual desire for the specific goods being exchanged. The emergence of standardized coins offered a solution, providing a universally accepted medium of exchange that simplified transactions and enabled people to quantify value more easily. For instance, the Lydians in ancient Anatolia are often credited with minting the first coins around 600 BCE, which set the stage for a more sophisticated economic landscape.

The impact of coinage on trade expansion cannot be overstated. With the ability to carry easily recognizable and divisible currency, merchants could conduct transactions over greater distances without the hassle of bartering. This newfound efficiency not only facilitated local commerce but also fostered international trade routes. The Silk Road, for example, thrived as merchants began using coins to exchange silk and spices across vast territories, thus enhancing cultural and economic interactions among civilizations. As societies embraced coins, consumer behavior evolved; people began to view wealth in terms of currency rather than physical goods, leading to a more complex understanding of value and economics.

Governments played a pivotal role in the regulation and minting of coinage, ensuring stability and trust in this new monetary system. By standardizing weights and measures, authorities could combat fraud and counterfeiting, which helped to bolster public confidence in currency. The Roman Empire is a prime example; its extensive use of coinage not only facilitated trade across Europe and North Africa but also served as a tool for asserting political power and control over conquered territories. Such financial innovations allowed governments to collect taxes more effectively and fund public projects, ultimately contributing to economic stability and growth.

As society progressed into this new era of coin-based transactions, the foundations were laid for future innovations in finance. The legacy of coinage continues to influence modern payment systems, where the principles of standardization and regulation remain vital in today’s complex economic landscape. Understanding these historical developments gives us valuable insights into how our current financial practices have been shaped by centuries of evolution.

Rise of Paper Money

The transition from coins to paper money marked a significant milestone in the payment evolution, driven largely by the need for a more convenient and efficient medium of exchange. While coins were tangible and durable, their weight and bulkiness posed challenges in large transactions. The introduction of paper currency in China during the Tang Dynasty (618-907 AD) offered a solution. It allowed merchants to carry higher values without the physical burden of metal coins, paving the way for greater trade flexibility. This innovation spread along trade routes, influencing economies around the world and laying the groundwork for modern financial systems.

Banking innovations further supported the rise of paper money, as institutions began issuing notes backed by precious metals or government guarantees. For instance, the establishment of promissory notes enabled individuals to transfer debt rather than physical currency, which enhanced liquidity in markets. By the 17th century, banks like the Bank of England issued standardized banknotes, facilitating trust in these new instruments and encouraging their widespread acceptance. This shift not only streamlined transactions but also stimulated economic growth and integration on a global scale, as countries began adopting similar systems to manage their monetary policies.

The effects of paper money extended beyond convenience; they profoundly influenced global trade dynamics and economic relationships. With easier means to transact, international commerce flourished, allowing nations to engage in trade networks previously hindered by coinage limitations. As economies grew interconnected, so did the complexity of financial transactions, ultimately leading to the development of electronic money and digital banking systems. These advancements can be seen as direct descendants of the paper currency revolution, demonstrating how historical innovations continue to shape contemporary finance and hinting at future integrations with blockchain technology that promise even greater efficiencies.

As we reflect on the rise of paper money, it becomes clear that this pivotal moment in payment evolution set the stage for today’s digital landscape. The convenience and trust established through paper currency paved the way for electronic payments, which now dominate our daily transactions. Understanding this journey not only highlights the ingenuity of past societies but also invites us to consider how emerging technologies like blockchain will further redefine our economic interactions in an increasingly cashless world.

Introduction of Credit Cards

The introduction of credit cards marked a significant evolution in consumer transactions, transitioning society from the tangible exchange of cash to a more abstract form of purchasing power. The first credit card, introduced in the 1950s by Diners Club, allowed users to dine at various restaurants without needing to carry cash. This innovation opened up new avenues for convenience and flexibility in spending, ultimately leading to a widespread adoption that transformed consumer behavior. Today, credit cards are not just a means of payment; they have become essential tools for managing personal finances, offering rewards, and providing a safety net for unexpected expenses.

As credit cards gained popularity, they significantly influenced spending habits. Consumers found themselves more willing to make larger purchases without the immediate pressure of paying upfront. This shift contributed to a culture of consumerism where buying on credit became commonplace. In fact, according to a report by the Federal Reserve, credit card usage has steadily increased over the decades, with Americans holding over $800 billion in credit card debt as of 2022. This rise in reliance on credit has shaped how individuals budget and manage their finances, often leading to discussions about responsible spending and the implications of living beyond one’s means.

Furthermore, the development of global credit systems and financial networks propelled the credit card industry into an interconnected marketplace. Companies like Visa and Mastercard established frameworks that allowed consumers to use their cards across borders, fostering international commerce and travel. The rise of e-commerce further amplified this trend, as online shopping became increasingly accessible. With mobile wallets now entering the scene, merging traditional credit card functionalities with advanced technology, the future of payments looks poised for even greater transformation. As we see mobile wallets integrating seamlessly into everyday transactions, the impact of credit cards remains foundational in shaping how we engage with our finances today and will continue to evolve in the years ahead.

Advent of Digital Payments

The advent of digital payments marked a transformative shift in the payment evolution narrative, paving the way for seamless online transactions and enhanced consumer convenience. With the rise of platforms like PayPal, Venmo, and Square, individuals and businesses alike began to embrace the ease of sending and receiving money at the click of a button. The proliferation of smartphones further accelerated this trend, allowing users to make purchases and transfer funds anytime, anywhere. This convenience redefined consumer expectations and set a new standard for how financial transactions are conducted.

As digital payments gained traction, significant advancements in payment security became paramount. Innovative technologies such as encryption, tokenization, and multi-factor authentication emerged to protect sensitive information during online transactions. For instance, Apple Pay and Google Pay leverage contactless payments that use near-field communication (NFC) technology to ensure safe and quick exchanges. These security measures not only bolstered consumer confidence but also facilitated the growth of e-commerce, enabling businesses to reach wider audiences without the limitations of traditional cash transactions.

The shift towards a cashless society has profound implications for both consumers and economies. Countries like Sweden and South Korea are leading the charge, with a substantial portion of their transactions occurring through digital means. This transition reduces the costs associated with handling physical cash, such as printing, distribution, and theft prevention. However, it also raises concerns about privacy and access; as society becomes increasingly reliant on digital payments, those without access to technology or banking services may find themselves marginalized. Balancing the convenience of digital transactions with equitable access remains a critical challenge as we move further into this cashless era.

In summary, the emergence of digital payment platforms has revolutionized the way we conduct financial transactions, offering unparalleled convenience and security. As we navigate this brave new world of contactless payments and digital currencies, understanding these advancements in payment security will be essential for consumers, businesses, and policymakers alike. The journey towards a fully cashless society is just beginning, and its implications will continue to unfold in the years to come.

The Cryptocurrency Revolution

The rise of cryptocurrencies marks a significant turning point in the evolution of financial transactions, introducing a decentralized payment method that challenges traditional banking systems. Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency and set the stage for an entire ecosystem of digital currencies. Unlike fiat money, which is governed by central banks, cryptocurrencies operate on blockchain technology, allowing peer-to-peer transactions without the need for intermediaries. This shift empowers individuals by giving them greater control over their finances and reducing reliance on traditional financial institutions.

As cryptocurrencies gained traction, they began to disrupt conventional banking and financial systems. For example, remittance services have been revolutionized by cryptocurrencies like Ripple (XRP) and Stellar (XLM), which facilitate fast and cost-effective cross-border payments. Traditional remittance services often charge exorbitant fees and can take days to process transactions. In contrast, using cryptocurrencies can reduce costs significantly and allow users to send funds almost instantly. This potential for efficiency has prompted many individuals and businesses to explore the benefits of adopting digital currencies, especially in regions with underdeveloped banking infrastructure.

However, the mainstream acceptance of cryptocurrencies faces several challenges. Regulatory uncertainty remains a significant hurdle, as governments worldwide grapple with how to classify and regulate these digital assets. Issues surrounding security, such as hacking incidents and fraud, have also raised concerns among potential users. Additionally, the volatile nature of cryptocurrency prices can deter individuals from using them as stable mediums for everyday financial transactions. Despite these obstacles, growing interest from institutional investors and the emergence of stablecoins—cryptocurrencies pegged to stable assets—are paving the way for broader adoption and integration into everyday commerce.

In summary, the cryptocurrency revolution signifies a profound shift in how we think about financial transactions. By leveraging blockchain technology, cryptocurrencies are not only enhancing efficiency but also promoting financial inclusivity. As the landscape continues to evolve, it will be crucial for stakeholders—ranging from regulators to consumers—to navigate these challenges while exploring the transformative potential of digital currencies in shaping the future of finance.

Blockchain Technology Impact

Blockchain technology represents a significant leap in the evolution of payment methods, primarily by enhancing transparency and security. Unlike traditional payment systems that rely on centralized authorities, blockchain operates on a decentralized network, ensuring that every transaction is recorded across multiple nodes. This not only makes it nearly impossible to alter transaction data retroactively but also instills trust among users. For example, companies like VeChain are utilizing blockchain to track supply chains, allowing consumers to verify the authenticity and origin of products before making a purchase. Such transparency fosters confidence in transactions, which is particularly vital in industries plagued by fraud.

Beyond cryptocurrencies, blockchain’s applications extend into various sectors, including finance, healthcare, and logistics. In finance, institutions like JPMorgan Chase have developed their own blockchain platforms to streamline cross-border payments, reducing transaction times from days to mere seconds. Similarly, in healthcare, blockchain is being explored for secure patient data management, where patients can control access to their medical records while ensuring privacy and compliance with regulations. These innovations highlight how blockchain is reshaping traditional business models and enhancing operational efficiency across industries.

Looking ahead, the prospects for blockchain-driven financial innovations are promising and multifaceted. As more businesses recognize the benefits of integrating blockchain into their operations, we may see the emergence of new financial products that leverage smart contracts—self-executing contracts with the terms directly written into code. This could revolutionize areas such as insurance claims processing or real estate transactions, making them faster and less costly. Moreover, as regulatory frameworks evolve to accommodate blockchain technology, we might witness broader mainstream acceptance of decentralized finance (DeFi) solutions that challenge conventional banking paradigms.

In summary, blockchain technology is a cornerstone in the ongoing payment evolution, providing enhanced security and transparency while also offering innovative applications across various industries. As we move forward, the ability to adapt and integrate these advancements will be crucial for businesses looking to thrive in an increasingly digital economy. The journey from barter to blockchain underscores the importance of continuous innovation in shaping the future of financial transactions.

Embracing the Future of Payment Evolution

The journey from barter to blockchain highlights key milestones in the evolution of payment methods. We’ve seen the transition from primitive trade systems to the sophisticated digital transactions we engage in today. Each innovation, from coinage to cryptocurrencies, has shaped the way we conduct business and interact financially. Understanding this evolution is crucial as it lays the foundation for future advancements in finance.

As we look ahead, the rapid pace of technological change encourages us to explore new payment technologies. The lessons learned from past innovations will guide us in adapting to emerging trends. Whether you are a finance enthusiast, a tech-savvy individual, or a cryptocurrency investor, staying informed about these developments is vital. The future of payment evolution is bright, and embracing it will open doors to new opportunities and possibilities.